NATIONAL TAKE-AWAYS

After a warmer-than-expected winter, natural gas is expected to continue to take market share from coal resources through 2020. EVA’s March 2020 Gas & Coal Price Sensitivity Outlook draws the following high-level conclusions:

- January coal burn dropped by nearly 20 million tons YoY, the largest monthly drop recorded in recent history. Weak electricity demand driven by mild winter weather and low natural gas prices were responsible for the decline. Total generation also fell by 5.5%, though gas burn rose by ~2.9 BCFD from 2019.

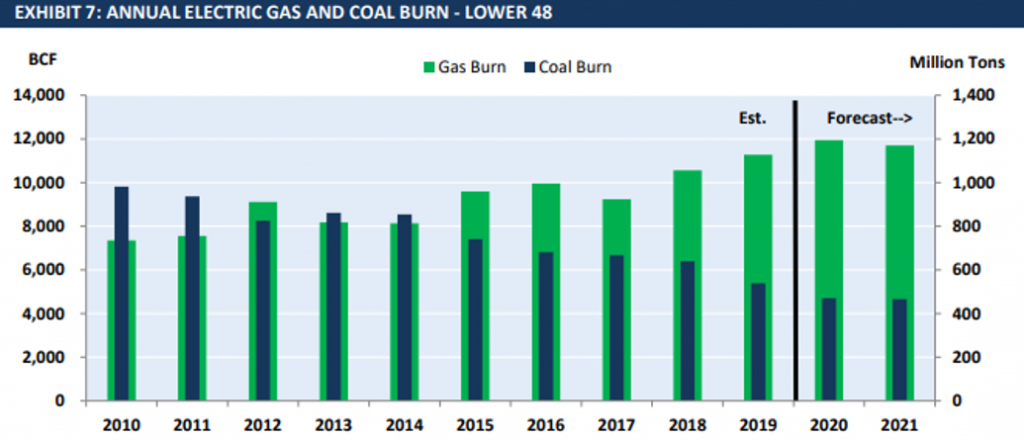

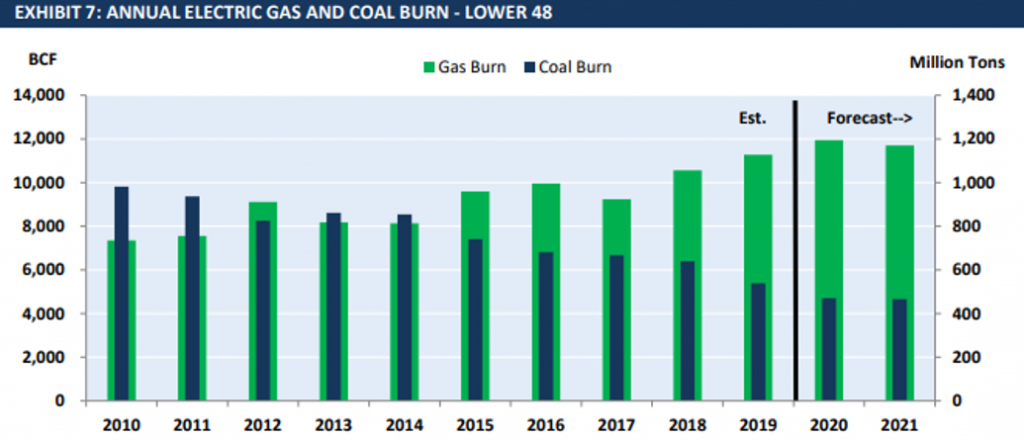

- EVA’s analysis indicates that annual coal burn for 2020 will drop to roughly 470 million tons, ~66 million tons below that of 2019. With higher gas prices in 2021, the drop in coal burn is expected to slow from the previous year and is forecasted at ~465 million tons. Gas burn is expected to drop in 2021 with higher gas prices and increased renewable penetration.

- EVA’s end-of-season storage facilitator calls for a 3.71 TCF storage level by October, given current supply-demand assumptions. However, to reach a 4.0 TCF goal, gas prices will need to increase by 40 cents for the May-October strip 2020, which will reduce power sector gas consumption by nearly 1.5 BCFD.

Regional Highlight

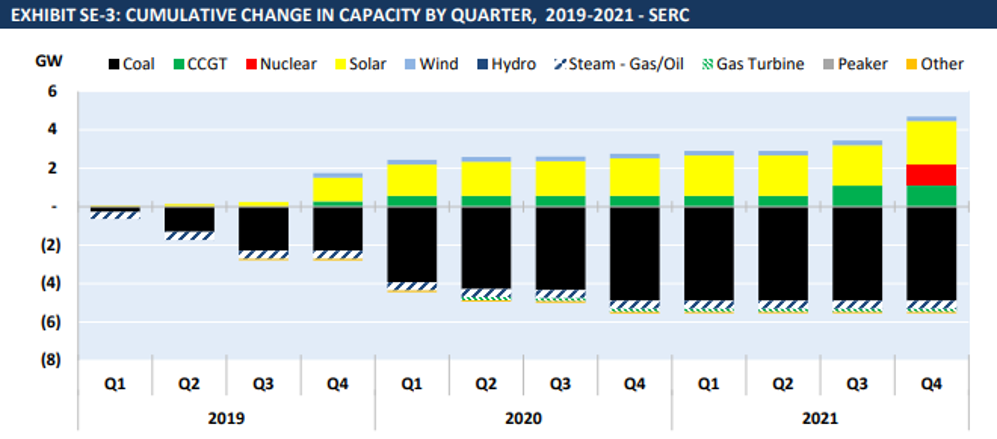

The report breaks up the United States in regions, detailing coal and gas burns, spark spreads, expected generation capacity change, and other influential factors. Annual coal consumption is declining by one of the largest margins in the SERC region, which will lead to a significant increase in CCGT capacity factors. EVA’s SERC highlights are as follows:

- SERC gas generation rose by 11% YoY in January, capturing 37% of the market while the share of coal generation fell from 27% in 2019 to 19% in 2020. Annual coal burn for 2020 is expected to decline by 16 million tons according to EVA’s analysis, while gas burn is projected to increase by 0.75 BCFD.

- Following the retirement of the 385-MW Asheville coal plant in NC, Duke Energy announced the retirement of 8 units totaling ~500 MW at the Darlington power plant in SC by the end of March 2020. The 8 oil-fired combustion turbines were slated to retire by the end of 2020 in Duke’s 2019 IRP.

- EVA’s analysis projects CCGT capacity factors to increase in 2020 to nearly 70% as low gas prices favor CCGTs over coal. Coal capacity factors are expected to dip below 40% as the weaker economics put coal units at a disadvantage compared to CCGTs.

EVA’s Gas & Coal Sensitivity Price Outlook is a one-stop-shop for understanding the impact of competition between natural gas and coal in the US power markets. The report is based on EVA’s proprietary scenario analysis of modeled assumptions, which provides high-level insight into a wide array of market-driven outcomes. For more information on our Gas and Coal Price Sensitivity Outlook or to find out more about our gas, coal, or power analytical products, please contact Rob DiDona at [email protected].

To understand our position on the impact COVID-19 on power and gas burn read our post here.