At the halfway point in OPEC’s six-month plan to reduce global supplies, the 11 participating OPEC members have reduced production 1.35 million barrels per day (MMBD) from Oct. levels. However, those production cuts have been partially offset by increases elsewhere in the world. This newsletter provides a granular assessment of these offsetting variances and addresses what is on the near-term horizon for global oil production. The impact of a muted decline, rather than a sharp drop, for global production on global inventories and oil prices is significant.

OPEC Production: Two Major Segments

At present there are two major segments for OPEC crude oil production, namely production for (1) the 11 participating OPEC members and (2) the remaining three non-participating OPEC members. With respect to the former, since Oct. these 11 participating members have reduced production 1.35 MMBD. However, included in this net number is (1) a reduction in Mar. for Iran of 200 thousand barrels per day (MBD), from its average production for Dec., Jan. and Feb., which may be an anomaly; and (2) production increases of 122 MMBD by Angola and Qatar. Excluding the latter two OPEC members total reductions were approximately 1.47 MMBD, with Saudi Arabia, Kuwait and the UAE accounting for 80% of the reduced production. Unique to Saudi Arabia is that it actually increased production in Feb. and Mar. from its Jan. production level by 260 MBD.

With respect to the non-participating OPEC members production has increased 130 MBD since Oct. This results in net production cut by all of OPEC of 1.2 MMBD with Saudi Arabia, Kuwait and the UAE carrying the brunt of the load, as noted above. For the non-participating OPEC members the real wild card is Libya, as a recent flare up in civil strife in the country impaired Mar. production levels. This flare up appears to be resolved – at least temporarily – which has allowed production from its Wafa field to resume to 160 MBD, with the potential to reach 220 MBD in the near future. Going forward Libyan production could exceed Mar. levels by 300 to 400 MBD.

Non-OPEC Production: Also Has Two Segments

Non-OPEC production, which includes all the remaining liquids production in the world, also can be divided into two segments, namely production for (1) the 11 participating Non-OPEC countries, which agreed to reduce production along with OPEC, and (2) the rest of Non-OPEC. With respect to the former, this group of countries has reduced production only 88 MBD versus a goal of 558 MBD. The primary reason for this phenomenon is production increases for Kazakhstan and Azerbaijan (i.e., 310 MBD), with Kazakhstan in the process of bringing online its world-class Kashagan field. With respect to the nine other countries, which in total reduced production 398 MBD, results have been mixed. Russia has reduced production 240 MBD and promises over time eventually to reduce production 300 MBD. Additive to this is Mexico, where production has been reduced 124 MBD, however this likely is due to natural declines.

At this halfway point, production costs by the 11 participating OPEC members and the 11 participating Non-OPEC countries are about 80% of the original goal, or 1.43 MMBD (i.e., using Oct. 2016 production as a reference point).

Rest of Non-OPEC: Production Growth

With respect to the remainder of Non-OPEC, total liquids production has increased 580 MBD since Oct., which offsets about 40% of the aforementioned net production reduction. The major drivers behind these production gains in order of importance are (1) the U.S., where production increases are led by the Permian Basin; (2) the U.K., where legacy projects continue to result in production increases; (3) Canada, with its continued growth in tar sands production; and (4) Brazil, which continues its offshore development program – albeit at a slower pace. The production increases to date for these four countries, which for the most part likely will continue in the future, were about 1.15 MMBD.

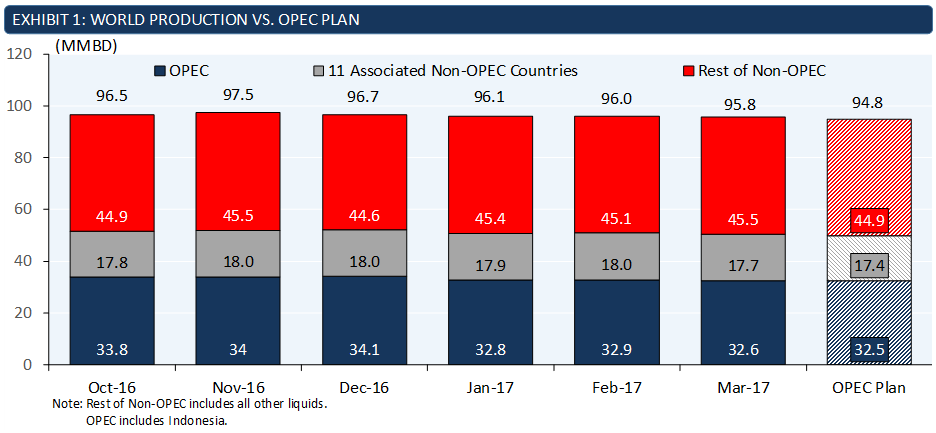

Exhibit 1 summarizes the production by month since Oct. for both OPEC and Non-OPEC, with Non-OPEC divided into the two aforementioned segments. Also, noted for comparison purposes is the original OPEC plan.

Going Forward: Global Production Changes Likely to be Modest

Between now and late May, when OPEC will evaluate whether or not to continue with its proposed plan to reduce production levels, it is likely that as a result of a series of offsetting variances total global production will remain close to Mar. levels. More specifically, the UAE already has announced that by May it will reduce its production levels an additional 200 MBD, primarily because of planned field maintenance, while Russia likely will continue to inch forward towards its pledged production cut of 300 MBD. Also, there likely will not be any further production increases by Kazakhstan and Azerbaijan.

Potentially offsetting these additional reductions within OPEC are (1) a return of Iraqi production to 4.0 MMBD and (2) increases from Ecuador, which is bringing on new production from a previously disputed field. Additive to this from Non-OPEC will be the continued production growth for Canada, the U.S. and Brazil. However, during the summer months scheduled maintenance, particularly in the North Sea, likely will result in a temporary decline for the production for the remainder of Non-OPEC and overall global production. This temporary phenomenon should be over by the end of the third quarter at which time Non-OPEC production gains likely will resume.

Implications

Assuming OPEC agrees to continue its current quotas, global inventories likely will decline in the second and third quarters. However, in the fourth quarter there likely will be a return to the current trend of increasing inventory levels. Furthermore, until a sustained reduction in global inventories starts to occur, price volatility likely will continue with prices at times below $50/BBL.