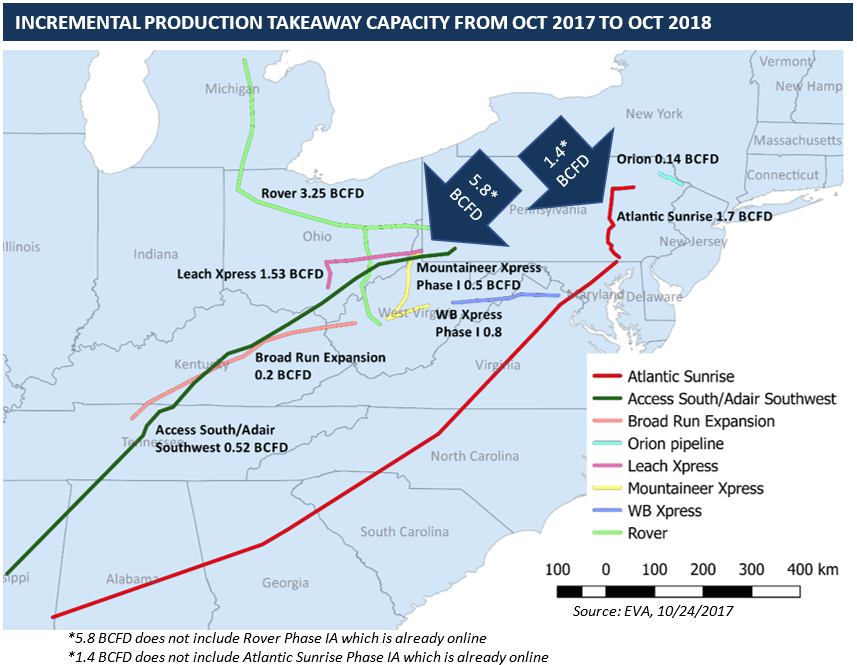

Over 16.4 BCFD of new natural gas pipeline capacity is expected to come into service between now and October 2018. A large chunk of this capacity (7.2 BCFD) aims to provide incremental production takeaway capacity, primarily in the Marcellus/Utica region (see map below). However, EVA’s most recent natural gas production forecast suggests these pipelines may flow at less than full capacity through much of 2018.

The remainder of the pipeline capacity (9.18 BCFD) coming online over the next year is associated with downstream market expansions, particularly those serving LDCs and under construction LNG export projects. In contrast to the pipelines focused on production takeaway, the market expansion pipelines are primarily located in the South (6.98 BCFD), with a smaller amount in the North (2.19 BCFD). Most of the capacity (8.04 BCFD) has already received FERC approval. The capacity in the South is almost exclusively focused on LNG export projects and new cross-border capacity to Mexico, while the capacity in the North is associated with LDCs and new CCGT plants.

Yet, as discussed in the November issue of EVA’s Short-Term Natural Gas Outlook, many of the total pipelines planned to come online over the next year face risks to their announced timelines, which in turn could have additional impacts on U.S. dry gas production. Most notably, the delay at FERC due to the lack of quorum for six months (which finally ended in August) is putting pressure on pipeline companies to meet their original in-service dates. The bulk of the capacity has, by now, received FERC approval, but many of the certificates came several months later than initially anticipated.

Further, pipelines associated with LNG exports could be delayed as a result of delays at a few LNG projects themselves. While the first U.S. LNG project—Cheniere’s Sabine Pass LNG—came online as scheduled, a few projects still under construction have experienced delays. Sempra’s Cameron LNG, originally scheduled to come online in 2018, has been pushed to 2019, while Freeport LNG has hinted its schedule would be shifted to 2019, as well. The pipelines designed to supply those projects may revise their timelines to match the timing of exports. Finally, pipelines targeting exports to Mexico could be delayed due to the uncertainty over the buildout of downstream pipelines in Mexico. As with the pipelines associated with LNG, their progress is effectively governed by the development of the projects/pipelines they’re intended to supply.

For more details regarding the pipeline projects, as well as their basis impacts, check out the latest issue of EVA’s Short-Term Natural Gas Outlook. Or feel free to reach out to Henan Xu, EVA’s lead natural gas analyst, at [email protected]