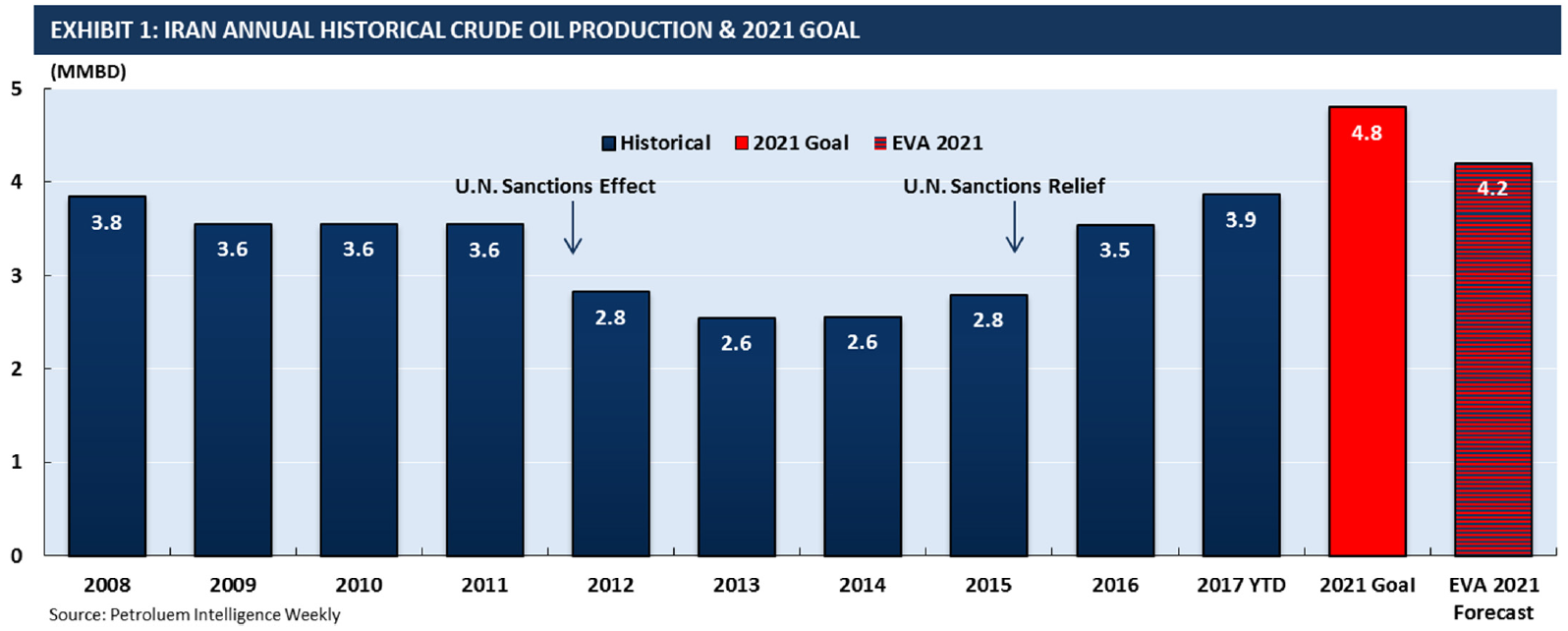

With the UN sanctions relief, Iran is seeking to revitalize its oil industry and already has raised oil production to near pre-sanction levels. The National Iranian Oil Company (NIOC) aims to increase production capacity through 2021 to 4.8 MMBD by appealing to global oil majors for capital investments and renovations to their drilling and production technologies. However, political risks resulting from the sanctions’ aftermath, as well as local skepticism towards foreign investments, questions the reality of the 2021 goal.

The UN sanctions lured capital away from Iranian oil fields, which resulted in oil production plummeting from 3.6 MMBD in 2011 to 2.6 MMBD in 2013. However, the relaxation of sanctions at the end of 2015 helped boost production levels back to 3.9 MMBD and now, the NIOC has set a 4.8 MMBD production capacity goal for 2021, requiring at least a $40 billion capital injection into Iran’s oil industry.

Exhibit 1 summarizes the annual crude oil production ranging from a time before the imposed UN sanctions until today and contrasts that with Iran’s 2021 production goal and EVA’s 2021 forecast.

The 2021 production goal is dependent on foreign investments to modernize Iranian oil production infrastructure. Consequentially, the NIOC has turned to International Oil Companies (IOCs) to develop their oil fields, many of which require brownfield investments to revitalize its outdated technologies, thus creating a ripe market for foreign investment.

Barriers to Foreign Investment

Developing prosperous economic relationships in Iran can prove wearisome for IOCs since the traditional Iranian psyche disincentives foreign investments. The Iranian autocratic political structure includes a supreme leader with veto power, Ali Khamenei, who controls the Islamic Revolutionary Guards Corps (IRGC), an organization dedicated to protecting Iran’s national sovereignty from foreign intervention.

The sanctions enabled the IRGC to adopt a more economic role as they filled the void of foreign investments in Iran, especially in the oil industry. Hence, the IRGC is reluctant to conclude business with IOCs to prevent a disturbance to their economic influence within Iran. The IRGC is also wary of relying on foreign investments amidst concerns regarding future sanctions, fearing that a reimposition of sanctions would drive away foreign investors, leaving Iran’s economy in a vulnerable state. Since the sanctions allowed the IRGC to expand their grasp to oil and gas fields, such as the giant Azadegan, IOCs looking to re-emerge in Iran after the nuclear deal would likely form partnerships with IRGC affiliated members.

The reintegration of IOCs in the Iranian market, with the notable exception of U.S. companies, is made possible by the Joint Comprehensive Plan of Action (JCPOA), Iran’s nuclear deal with the UN’s major powers. Independent of the JCPOA, current U.S. sanctions prevent petroleum development in Iran as U.S.-Iranian tensions remain high. Even though the U.S. recently waived nuclear sanctions, it has placed the JCPOA under an interagency review by the National Security Council, leaving the future of the Iran Deal uncertain. Furthermore, President Trump’s public statements expressing discontent with the JCPOA, and the ongoing suspicion of fostering terror groups puts Iran in the political spotlight. However, concerns regarding political legitimacy are more than offset by the competitive pressures amongst foreign oil and gas firms.

Current Iranian Efforts

On May 20, Iran responded to international scrutiny by re-electing their current president Rouhani, who carries a reformist agenda aimed at reintegrating Iran in the global market. The election indicates that the voting majority favors global interactions, providing an informal invitation for international businesses to invest in Iran.

In an effort to attract IOCs, the NIOC, during its latest Oil Exhibitions in Tehran, offered 52 E&P projects, while partially revealing new buy-back contracts, named the Iran Petroleum Contract (IPC). The IPC is a restructured model of Iran’s conventional buy-back contract, which fundamentally was a risk service contract heavily criticized by IOCs for its immense capital uptake and its short cost recovery period. Facing constant approval delays and backlash from Iran’s hardliners, the eagerly anticipated IPC would allegedly allow longer contract durations (20-25 years) for enhanced cost recovery, a joint venture between IOCs and a local partner, and improved risk mitigating terms. The IPC opens a gateway for IOC’s to re-enter the oil market, and therefore allows the introduction of new E&P technologies and technical expertise. However, complete details of the model have not yet been publicized.

Regardless, 34 companies including Total, Shell, Eni, CNPC, and Sinopec have been qualified by the NIOC to bid in oil and gas tenders. This list excludes BP and any U.S. energy company, although Iran’s Oil Ministry announced its willingness to cooperate with U.S. oil firms. The NIOC remains adamant about developing relations with other oil majors as it extended invitations to the qualified companies to tender for one of Iran’s major oil projects, the South Azadegan field. Total, Inpex Corporation, and Petronas have submitted the first of many expected proposals for the development of the South Azadegan project, which contains nearly 6 billion barrels of recoverable oil. On July 3, Total signed an IPC for the development of phase 11 of the South Pars gas field, becoming the first international company to re-emerge in Iranian oil and gas industry. Iran’s oil ministry hopes this deal will set the path for other IOCs to follow.

EVA Analysis

The relief of economic sanctions on Iran has provided a lifeline for their underinvested oil industry. However, the 2021 production goal seems highly aggressive. Iran’s compliance with the JCPOA has encouraged investors, but the possibility of new sanctions can’t be written off. Separately, the constant internal battle between moderates (i.e. Rouhani) and conservatives (i.e. IRGC) has impeded Iran’s progressive movement on finalizing deals with IOCs, which can be characterized by ambitious claims and a lack of closure. Despite current efforts, on a local and international scale, Iran’s foreign investment climate remains infantile and laden with risk. Assuming continuous opposition from Iran’s hardliners, EVA forecasts a production increase to only 4.2 MMBD by 2021. At the current rate, investments from IOCs could take years to commence, and although a production capacity increase is highly likely, reaching 4.8 MMBD by 2021 is not.

For more information on North American crude oil markets, please contact us at [email protected].