Dry gas production in the Marcellus and Utica, which now comprises about 35% of total U.S. L-48 dry gas production, has steadily increased through 2017. The consistent increase in output has coincided with rising rig counts, as well, but total rigs remain well below 2014 peaks. This is a clear sign that producers in the Northeast have succeeded in growing production while operating fewer rigs. This is not the first time the relationship between rig count and production has decoupled—it occurred in 2012, as well—but the current dynamic represents a clear and persistent effort on behalf of producers to improve capital efficiency. At the start of 2015, there were 123 rigs in the Appalachia region, with gas production per rig averaging 7.5 MMCFD. Today, the rig count is holding near 75, while production per rig has effectively doubled to 14.3 MMCFD.

Based on our review of the most recent quarterly earnings reports for major Northeast producers, the emphasis on capital discipline is likely to continue. Further, 12 producers operating in the region have committed to about 5 BCFD of new pipeline takeaway capacity and the 3Q operating results reveal some interesting indications regarding the magnitude of incremental production increases in 2018, as well as the potential impact on Northeast basis. Other highlights include the following:

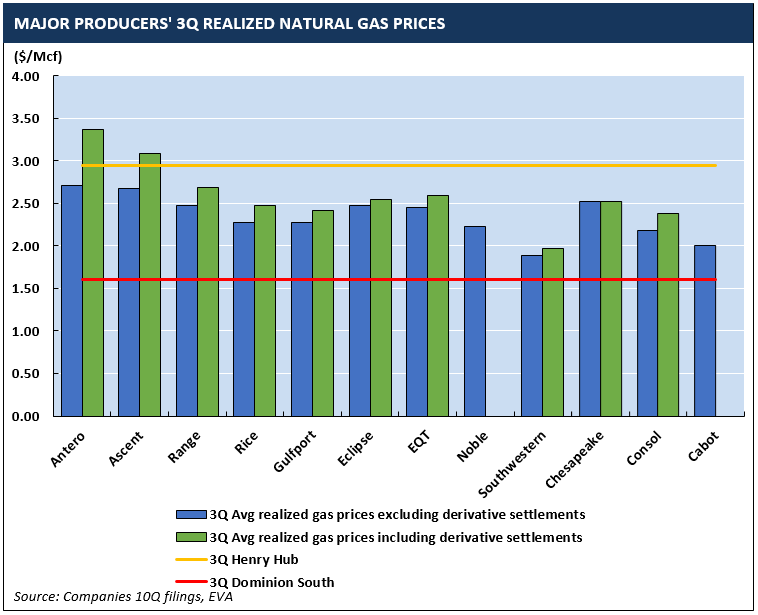

- Better operating results than 3Q 2016, driven by higher commodity prices and continued production growth. 3Q realized dry gas prices for the Northeast producers studied ranged from $1.89/MMBtu to $2.71/MMBtu depending on operators’ locations and the availability of transportation to premium markets (3Q Henry Hub prices averaged $2.95/MMBtu, while Dominion South averaged only $1.60/MMBtu, see figure above). Despite very low 3Q Dominion South prices, most producers were able to achieve average realized prices well above $2/MMBtu, with even better results after hedging.

- Improved capital efficiency through lower drilling and completion costs. Across all producers, some clear trends emerged. Average lateral length has increased, larger pads were built, cycle times were almost cut in half, frack stages and clusters were further optimized, more proppants were used and water related logistics were improved. Several producers (e.g., Antero) said that with the same number of rigs in 2017, they can achieve about 20% production growth in 2018 solely through efficiency gains.

- EQT will become the largest gas producer in the U.S., edging out ExxonMobil, as a result of its acquisition of Rice. Owning continuous acreage will help EQT and Rice increase the lateral lengths of their wells, which is an important objective for many producers in 2018 (e.g., Eclipse’s super laterals).

- Asset sales of non-core and scattered acreages could continue. Chesapeake and Consol have led the trend through 2017 and several additional producers are looking at opportunities to drop down or sell their midstream assets (e.g., Antero, Noble, Cabot). Producers hope these asset sales or drop-downs will help them deleverage, achieve better debt ratios and boost credit ratings.

- Rising NGL prices have given a significant boost to producers in the liquid-rich parts of the Marcellus and Utica (e.g., Antero). NGL composite prices have increased by more than 35% compared to 3Q 2016, whereas Henry Hub prices only increased by 2.6%. Similarly, producers with oil-rich assets in the Permian, SCOOP & STACK, and DJ, stated they will mostly focus their activities in these areas in 2018 rather than expanding their presence in the Northeast (e.g. Gulfport, Noble).

- Almost all producers emphasized their desire to remain or become cash flow neutral. Almost none plan to increase CAPEX or rigs significantly in 2018. To some extent, the focus has been shifted from pursuing growth to pursuing returns (e.g., EQT). This is certainly bullish for gas prices, however capital discipline has been promised before and could prove fragile in the face of recovering prices.

- Many producers believe it will take time (12-18 months) to fill pipelines with new production from their own operations. Therefore, in order to meet their capacity commitments, they will seek to buy gas from third parties on the market. As a result, Northeast basis—particularly TETCO M2 and Dominion South—are forecast to improve in 2018. Taking the 2018 guidance into account, a 3 BCFD of increase in Northeast gas production can be expected from the major producers studied, suggesting many will rely quite heavily on smaller producers to fill the incremental capacity or backfill existing capacity.

For more detailed overviews of the individual companies referenced above, please see EVA’s Short-Term Natural Gas Outlook. You can download a free copy of the monthly report here, or contact EVA’s Lead Natural Gas Analyst, Henan Xu, at [email protected].