Energy Ventures Analysis (EVA) has released a comprehensive report commissioned by the American Petroleum Institute (API), offering in-depth analysis and critical insights into the dynamic landscape of U.S. liquified natural gas (LNG) exports. The report thoroughly examines the transformations witnessed by the energy industry over the past 15 years, providing essential context to recent fluctuations in natural gas pricing.

Delving into the natural gas industry’s supply-demand balance, the report analyzes historical trends in domestic prices and their correlation with the country’s natural gas exports. In 2023, the U.S. achieved a remarkable milestone by becoming the world’s largest LNG exporter. Despite soaring U.S. natural gas exports and domestic consumption in recent years, domestic natural gas prices have remained among the lowest globally.

With the country’s leadership in LNG exports, critics of expanded export capacity have raised concerns about increased financial burdens on U.S. natural gas consumers. Pointing to the substantial rise in U.S. natural gas prices in 2022, critics of increased U.S. LNG exports argue that this growth exacerbates domestic economic challenges. EVA’s report provides a comprehensive assessment of changes in the U.S. natural gas industry, offering essential context to the natural gas pricing anomaly of 2022 and reviewing the domestic and global benefits of U.S. natural gas exports.

Key Findings:

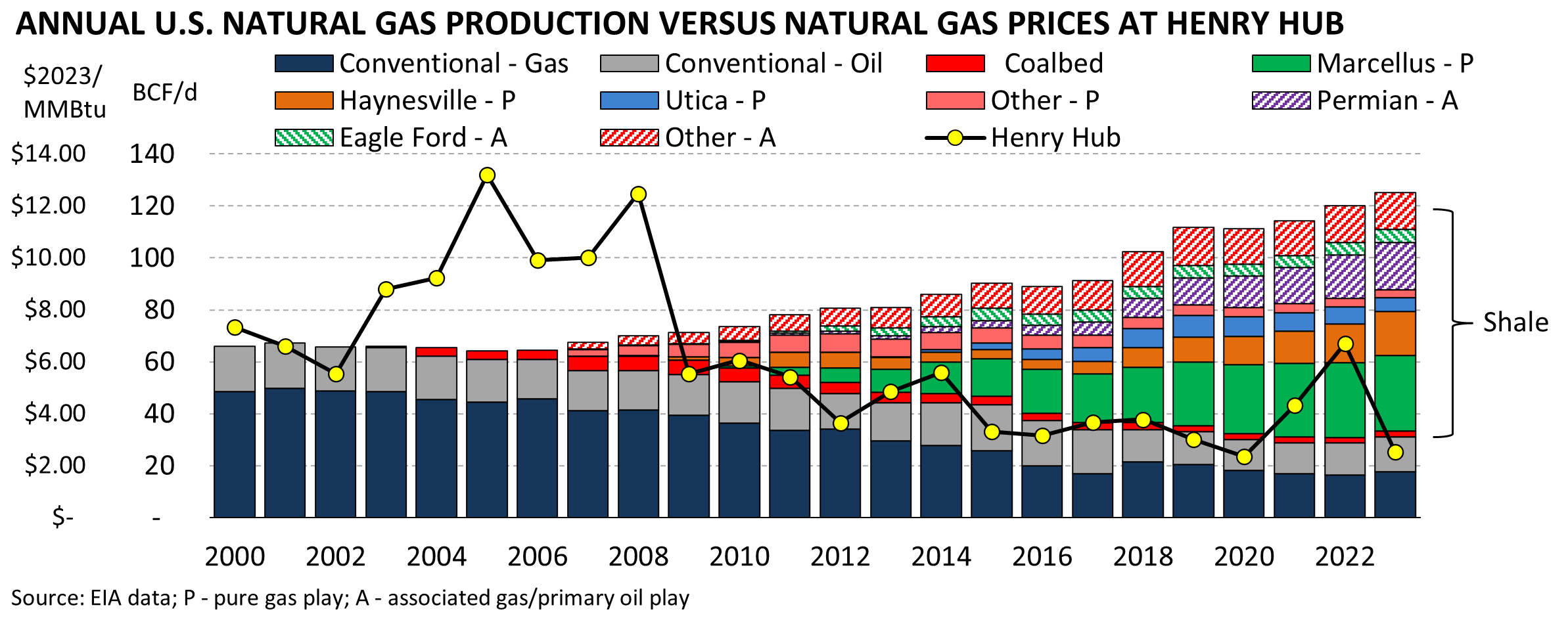

- The shale gas revolution resulted in a massive shift in U.S. natural gas supply and demand flows, ringing in a new era of low-cost natural gas supply and turning the U.S. into a global energy superpower.

- Despite a record level of natural gas exports during the first six months of 2023, U.S. natural gas prices at Henry Hub averaged $2.48 per MMBtu, the lowest six-month average in over 35 years (outside of the COVID-19 pandemic).

- Unique post-COVID-19 pandemic circumstances and U.S. coal market exposure to global markets—not U.S. LNG exports—were the primary factors behind domestic natural gas prices briefly increasing to 14-year highs in 2022.

- Virtually unchanged LNG export terminal utilization from 2021 to 2023 and the substantial disconnect between domestic and international natural gas prices highlight U.S. natural gas exports’ minimal impact on domestic natural gas pricing.

- The completion of U.S. LNG export terminals has had minimal impact on short-term domestic natural gas pricing due to their lengthy construction times and unique long-term financing and contracting structures.

- Increased U.S. natural gas exports have and will continue to create massive economic benefits for U.S. communities while providing global access to the reliable U.S. natural gas supply needed to further the global energy transition from higher greenhouse gas (GHG) emitting fuels to lower-GHG emitting natural gas.

- Restricting natural gas infrastructure development will impede continued access to low-cost natural gas supply, regardless of U.S. LNG export levels.

Click here to view the executive summary and full report.

For further information and enquiries please reach out to us at [email protected].

__________________________________________________________________________

Energy Ventures Analysis (EVA) is a leading energy consulting firm dedicated to providing strategic insights and analysis to industry stakeholders worldwide. With a team of seasoned experts and a commitment to excellence, EVA delivers actionable intelligence to navigate the complexities of the energy sector.