In the early hours of March 26, 2024, the maritime and energy sectors witnessed a significant disruption when a containership collided with a support pillar of the F.S. Key Bridge in Baltimore, causing a catastrophic collapse. This unforeseen incident has not only severed a vital artery for the city’s transportation network but also immediately halted all Baltimore coal exports, the city being one of the United States’ key coal export ports.

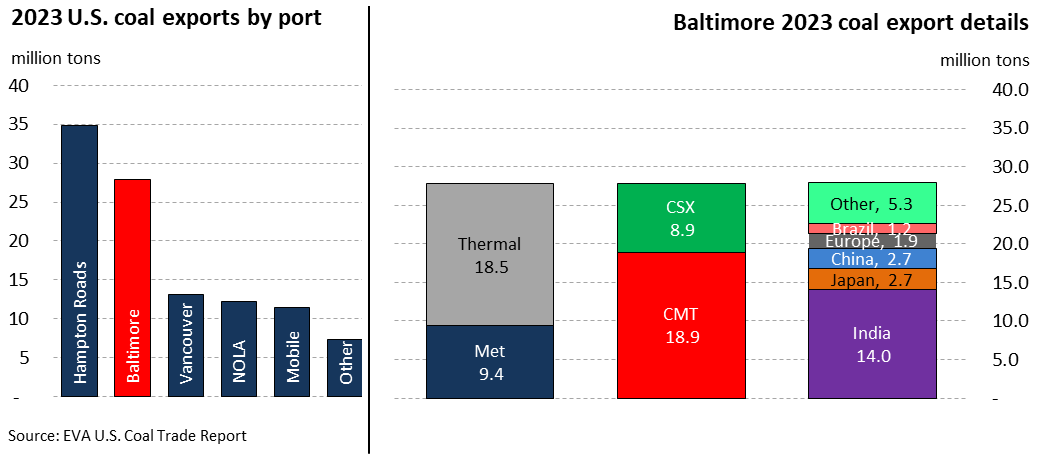

Baltimore, recognized as the second-largest coal export port in the United States, trailing only behind Hampton Roads, is crucial for coal exports. According to EVA’s U.S. Coal Trade Report, in 2023, Baltimore’s terminals facilitated the export of approximately 28.1 million tons of coal, comprising 9.5 million tons of metallurgical (met) coal and 18.5 million tons of thermal coal. This volume of Baltimore coal exports was handled primarily through the Consol Marine Terminal and the CSX Curtis Bay Terminal, which, combined, play a significant role in meeting the global demand for coal, especially from major consumers like India.

In response to this crisis, a potential short-term solution is diverting some coal shipments to Hampton Roads, Virginia. This alternative route benefits from access by both major U.S. eastern railroads, CSX and NS, offering a temporary bypass for some of the stranded coal exports. However, this reroute is not without its limitations and challenges, particularly concerning the logistical capacity to handle the potential sudden influx of shipments.

The incident has also cast shadows over local energy infrastructure, with the Brandon Shores and Wagner coal plants facing potential supply disruptions. EVA believes that barge deliveries to these plants can resume shortly, thanks to their low draft requirements and the fact that these operations do not rely on the major ship channel affected by the bridge collapse.

The halt in coal exports poses a significant risk to global coal supply, particularly to major importers like India. The Indian cement and brick industry, a substantial thermal coal consumer, faces possible supply constraints. Due to the interconnected nature of global commodity markets, this could potentially influence CFR India pricing and even impact FOB Richard’s Bay pricing.

As efforts to clear the debris and restore safe passage are underway, the focus also turns to the long-term implications of this event. President Biden’s commitment to rebuilding the bridge is a positive step forward, yet the timeline for such a massive infrastructure project remains uncertain. In the meantime, CSX Curtis Bay and CONSOL’s Marine Terminal utilize their on-site storage capabilities to mitigate the immediate fallout from the halt on Baltimore coal exports, allowing for continued rail offloading amid limited operational continuity.

EVA will continue to monitor the situation closely and update its clients on any further significant developments through its regular coal publications, including the weekly Global Thermal Coal Report and the monthly U.S. Coal Trade Report.

For further information and enquiries please reach out to us at [email protected].