Executive Summary

In an effort to increase resilience ahead of summer 2019 the Texas Public Utility Commission has approved reforms that will increase prices during high-demand periods in the Electric Reliability Council of Texas (ERCOT) region. The reforms are expected to incentivize generators to defer retirement, while also sending price signals to customers to curtail electricity usage during periods of high demand and to invest in customer sited resources. The short-term outcome of this policy will be higher prices, a lower probability of outages, and economic support to generators at the margins of retirement. In the long run, this policy is likely to increase investment in demand response, energy efficiency, distributed resources, and other non-traditional sources of meeting electricity demand.

Background

Last month the Texas Public Utility Commission (PUC) approved a reform of the operating reserve demand curve (ORDC), a market mechanism that increases wholesale electricity prices when demand increases during times where reserves are low. The ruling was made in anticipation of the summer reserve margin shrinking to only 7.4 percent— a quantity well below the targeted 13.75 percent. The PUC also ruled in favor of ERCOT implementing real-time co-optimization of energy and ancillary services, but rejected a proposal to include marginal line losses in the dispatch of generation.

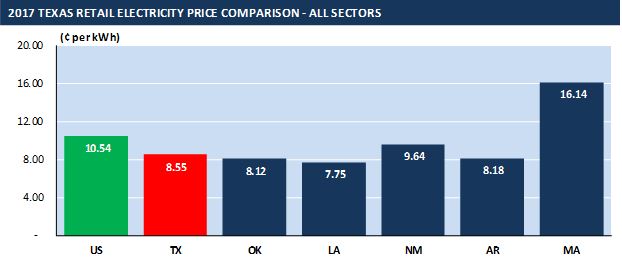

Most electricity markets include a capacity market as a mechanism to ensure that the system has sufficient generation. ERCOT does not have a capacity market, but instead operates under the idea that price movements created by the supply and demand balance will send investment signals to the private market. At the same time Texas enjoys some of the cheapest electricity prices in the country. Figure 1 illustrates how electricity prices in Texas compare to bordering states, the national average, and Massachusetts. These combined factors, as well as the rise of natural gas, has led to the decline of coal generation in the state.

Figure 1

Source: Energy Information Agency

Summer reserve margins in ERCOT receive a lot of attention—particularly because Texas is hot, air conditioning proliferates, and there is no capacity market. The mechanism behind the recent ERCOT ruling increases the standard deviation that is used for the loss of load calculation, which in turn increases the frequency and quantity of the price adder that is offered to generation during periods of high electricity demand. Essentially, higher prices will be offered for generation on more days, even if conditions remain the same. The standard deviation will be increased by .25 for the summer of 2019 and then will be increased by an additional .25 standard deviation before summer 2020. In addition to shoring up reserves before the summer, PUC Chairman DeAnn Walker’s comments reflect that the overarching intent of the reform is threefold: to defer additional retirement for struggling units, to incentivize demand response development, and to spur private investment in customer sited resources.

The reform is expected to significantly impact power prices. The PUC estimated that the cost to customers will be roughly $80 million over the course of two years—but this cost assessment assumes that the higher costs will increase investment, decrease retirements, and cause customers to curb consumption. Another estimate from the Texas Public Policy Foundation suggests that the reform could increase costs by hundreds of millions annually—increasing retail electricity prices by about 13%.

Analysis

Power Markets

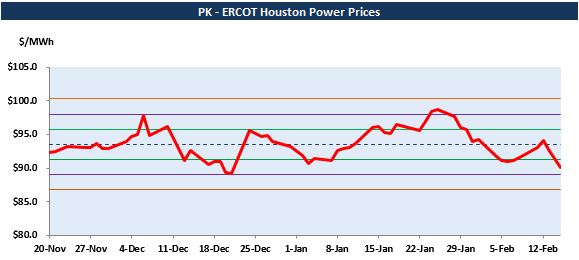

Energy Ventures Analysis (EVA) expects that the market reform will have a few key impacts. First and foremost, our power team believes there is likely to be a significant upside for summer 2019 power contracts. As of today (February 19, 2019), on-peak power contracts at the ERCOT Houston Hub are trading more than 1 SD below the 60-day moving average. Figure 2 provides a snapshot of on peak power contracts trading at the ERCOT Houston Hub for the months of May through August 2019. The anticipation of higher prices, particularly when weather models and natural gas dynamics begin to paint a more accurate picture of summer power dynamics, is likely to cause increased activity in the futures market.

Figure 2

Source: Energy Ventures Analysis, Energy Trader Dashboard: Term Power Outlook

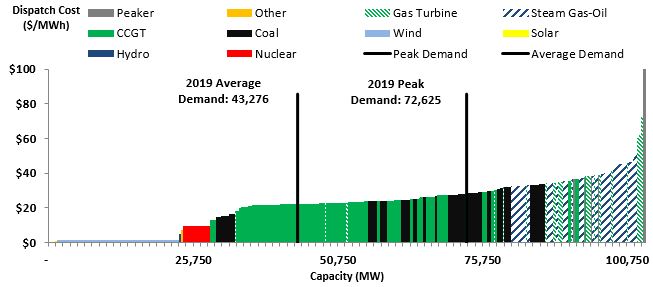

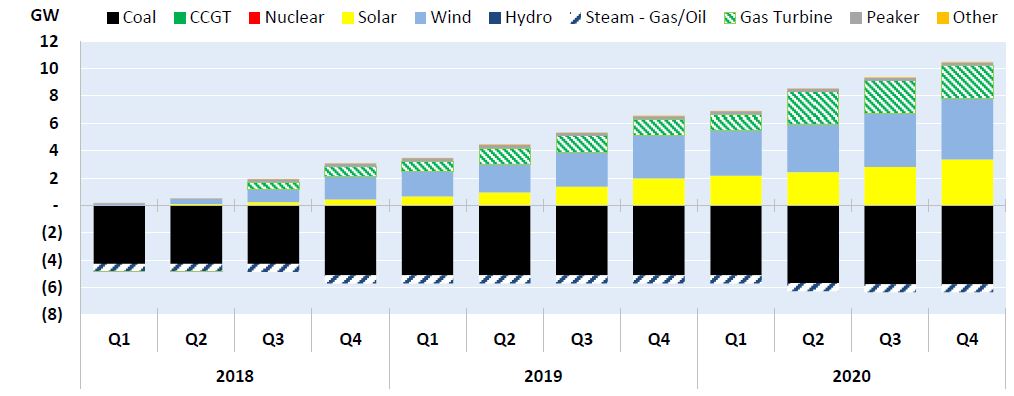

The reform could have a significant impact on generation units that are on the margin. As depicted in Figure 3, a number of coal, CCGT, steam gas, and peaking gas turbines could see a slight upside—with improved economics compelling them to stay online during the volatile summer period. At a time when coal and steam-gas generation are expected to decline significantly, this reform could at least somewhat slow the pace of retirements—providing the type of short-term stability that the Texas PUC desires. EVA’s anticipated cumulative change in ERCOT’s capacity is depicted in figure 4.

Figure 3: ERCOT Full Load Supply Stack for 2019

Source: Energy Ventures Analysis: Coal & Gas Price Sensitivity Outlook Note: Renewable resources have a marginal cost of dispatch of $0/MWh

Figure 4 Cumulative Change in Capacity by Quarter, 2018-2019 – ERCOT

Source: Energy Ventures Analysis: Coal & Gas Price Sensitivity Outlook

Distributed Energy Resources:

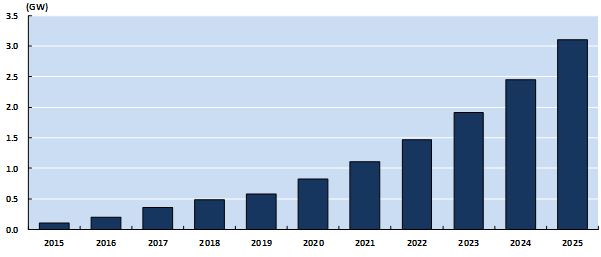

The increase in peak energy prices is likely to cause price sensitive customers to consider the benefits of behind-the-meter resources. Texas, of which the ERCOT territory makes up the majority of the state, only had around 400 MW of distributed solar in 2017. Despite its significant solar potential, rooftop PV in Texas has lagged behind states with policy support for distributed generation like Massachusetts where there was more than 1 GW of solar in 2017. Elevated electricity prices could accelerate the deployment of rooftop solar in Texas— which could help shore up grid resiliency during summer months and defer potential transmission investments. EVA currently forecasts that there will be more than 3 GW of distributed solar in Texas by 2025. Distributed solar could be further accelerated if commercial and industrial (C&I) customers seek to reduce energy payments with investment in behind the meter storage. Investment in utility scale and renewable resources could be further accelerated if Congress extends the federal investment tax credit—a policy that Democrats have signaled would be a priority in any bipartisan infrastructure bill. Such market changes would transform the fundamentals of the ERCOT market.

Figure 5 Short Term Distributed Energy Capacity Forecast: Texas

Source: Energy Ventures Analysis: Renewable Energy Report

Conclusion:

The ERCOT price reform will likely increase prices and stability in the short term, while sending longer term signals that incentivize customers to invest in demand side resources. The Texas PUC is using pricing mechanisms to create a more flexible and resilient grid in the ERCOT territory.