A bipartisan bill (H.B. 3987) filed by two Illinois state representatives on December 9 would effectively repeal a subsidy that Exelon receives via the sale of Zero Emission Credits (ZEC) by granting an exception to customers of electric utilities that serve more than three million retail customers in the state. If the bill is signed into law there could be a significant upside for natural gas plants in the state.

The subsidy was part of the Future Energy Jobs Act (FEJA), which was enacted in December 2016 by the Illinois state legislature. Among other things, FEJA requires utilities to purchase ZECs from Exelon’s 1,800-MW Quad Cities and 1,065-MW Clinton nuclear plants in order to prevent their premature retirement. The subsidies, which critics claim amounts to a bailout of a profitable company, were challenged unsuccessfully in court by independent power producers who argued that the payments interfere with competitive markets and infringe on federal regulations. The U.S. District Court for Northern Illinois rejected the argument on the grounds that ZECs are akin to renewable subsidies and do not infringe on FERC’s jurisdiction over power markets. EVA estimates that Exelon earns more than $230 million per year via the sale of ZECs to the state’s major utilities.

The new bill to block the subsidy, which was sponsored by IL Rep. Mark Batinick (R) and co-sponsored by Rep. Kelly Cassidy (D), was prompted in part by ongoing FBI and SEC investigations into Exelon’s lobbying efforts related to FEJA’s passage. While H.B. 3987 will face a difficult path through the state legislature, its passage could drive the retirement of 3,000 MW of nuclear capacity in Illinois and provide an opportunity for other types of generation to gain footing.

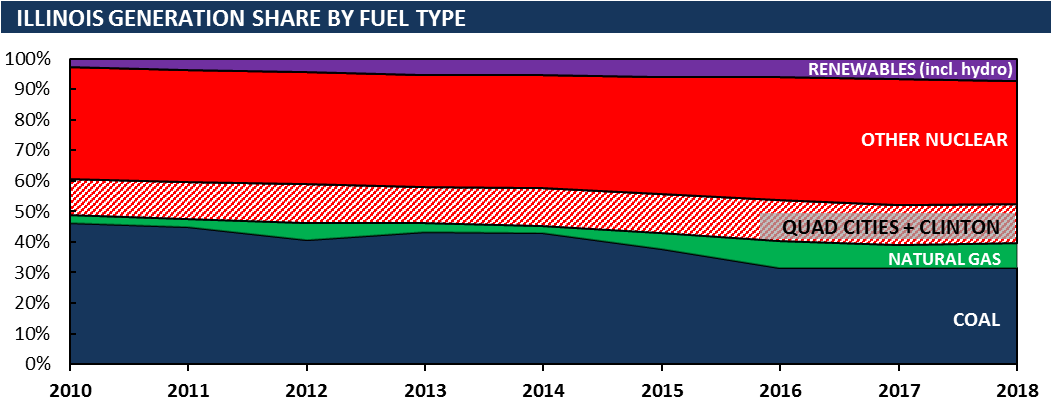

Nuclear plants typically account for more than half of total power generation in Illinois. As such, gas-fired power generation has not grown as rapidly as it has in other states despite rock-bottom gas prices and the retirement of more than 7,000 MW of coal-fired capacity since 2010. Illinois’s gas-fired combined cycle (CCGT) fleet, which comprises roughly 3,500 MW, ran at a capacity factor of just 37% in 2018, well below the combined PJM and MISO CCGT fleet capacity factor of 58%. Due to the dominance of nuclear power in Illinois, the state’s power sector gas consumption reached just 139 billion cubic feet (BCF) in 2018, down slightly from the prior two years and substantially less than that of nearby states with similar access to low-cost gas.

Note: Quad Cities and Clinton's share of generation represents potential upside for natural gas if plants retire.

The passage of H.B. 3987 and potential subsequent retirement of the Quad Cities and Clinton nuclear plants, which combine to produce roughly 24,000 GWh of electricity annually, likely would drive increased utilization of Illinois’ existing gas-fired power plants and the potential need for the development of new generating capacity. Specifically, Hoosier Energy’s 650-MW Holland gas plant has run at an average capacity factor of just 15% over the past five years. Similarly, Berkshire Hathaway’s 600-MW Cordova plant has run only sparingly since 2010. The retirement of Exelon’s subsidized nuclear plants could improve the competitiveness of these facilities and boost their utilization.

While the state’s coal fleet also has room to ramp up, EVA believes that sustained weak natural gas pricing will make gas plants a more economical alternative.