In 2019 EVA’s Quarterly LNG Outlook tracked import and export terminal progress, global supply and demand dynamics, and the resulting price price environment. Our major LNG Market 2019 takeaways are as follows:

Gas Glut and Price Slump in LNG Market:

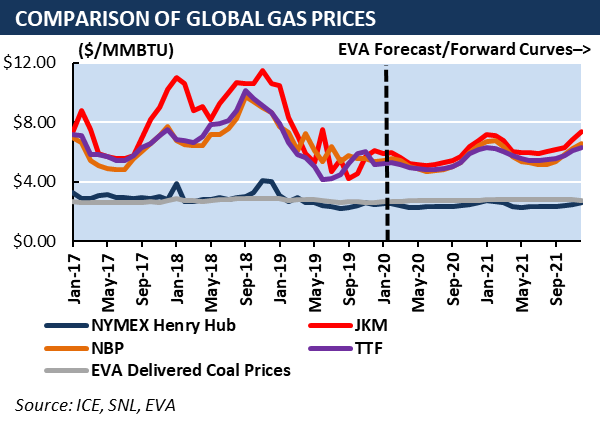

Mild weather and oversupply drove both Asia and Europe LNG indices to collapse in 2019. Although markets saw some short-term upward volatility over the summer, at the end of 2019, JKM fell nearly 40% from ~$10/MMBTU in January and NBP was down 28% from ~$8/MMBTU. The average price premium of NE Asia spot LNG to Europe dropped below 15 cents for the first time, which sent cargoes towards the European market, filling continental storage to above 85% as early as August.

Asian Demand Shift:

Weaker JKT Market

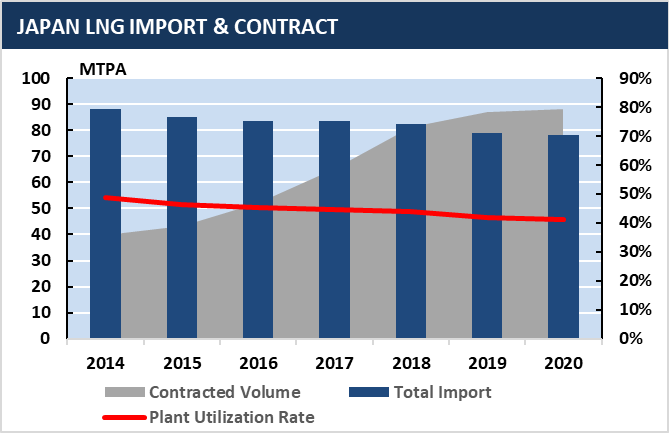

Imports from traditional JKT buyers tumbled in 2019. Japan and South Korea bought 5-8% less LNG YoY in 2019 as temporarily shuttered nuclear plants restarted in a mild demand environment. Only Taiwan maintained its 2018 LNG import volume. Japan’s over-contracting situation emerged in 2019 and may sustain through 2020. Meanwhile, market liberalization and low spot LNG prices continue to incentivize small-scale spot market purchases as dictated by demand.

Slower Growth in the Chinese LNG Market

LNG imports from China surpassed Japan for two consecutive months at the end of 2019 even with the Russian Power of Siberia pipeline starting gas deliveries in December. However, the 10% 2018/19 YoY LNG growth rate was nearly 30% below the 2017/18 growth, largely a result of Beijing’s relaxed anti-coal stance (read EVA’s take on the trade war’s impact on LNG here).

Emerging Market in Southeast Asia

Southeast Asia LNG imports climbed more than 20% in the past year. Thailand and the Philippines altogether announced more than 7 MTPA of new capacity in 2019 while over 3 MTPA is under construction in Thailand, Cambodia and Vietnam. Nations in Southeast Asia region are planning on building roughly 20 MTPA of cumulative LNG import capacity by 2025 as economies grow and major gas reservoirs in the Philippines and Indonesia reach depletion. Further growth in Southeast Asia LNG demand is poised to play an increasingly vital role in mid-term global market balance.

Other Major Trends and Factors:

European Import Capacity Utilization High in 2019

Compressed JKM-TTF spreads (even shift from discount to premium in summer) drove 60% more YoY LNG delivery volume into Europe. Europe’s largest LNG terminal- Grain LNG in UK hit a one-day regasification record in November, while Italy, France, and Lithuania are fully booked for regasification capacity in the current gas year. Geopolitics played an increasingly critical role in the gas supply to Europe. In 2019, EU funded over 360 million Euro to new terminal projects in Croatia and Poland which are set to import more U.S. and Qatari LNG. Imports will supply Russian-gas-dependent central and eastern Europe.

Flipping Imports to Exports

Egypt and Argentina became net exporters for the first time in 2019. Growing Egyptian domestic production, piped Israeli gas deliveries to Egypt, and scaling productions from Argentina’s Vaca Muerta were factors that pushed Egyptian and Argentinian LNG exports in 2019. Mexico had a similar story as its LNG import terminal (Energia Costa Azul) in Baja California was converted for exports. The opening of Sur de Texas – Tuxpan pipeline that transports U.S. gas into central Mexico could potentially displace half of the LNG received at its second-largest import facility Altamira in the short-term.

EVA’s Quarterly LNG Outlook is designed to provide a deep but concise dive into the global LNG industry. Special focus is given to the ongoing development of U.S. LNG export projects, but global issues—including crucial shifts in pricing dynamics—are explored in-depth as well. The report includes short-term (3-year), country-by-country supply and demand forecasts, insight into the main trends impacting each region, and access to EVA’s LNG database.