Executive Summary

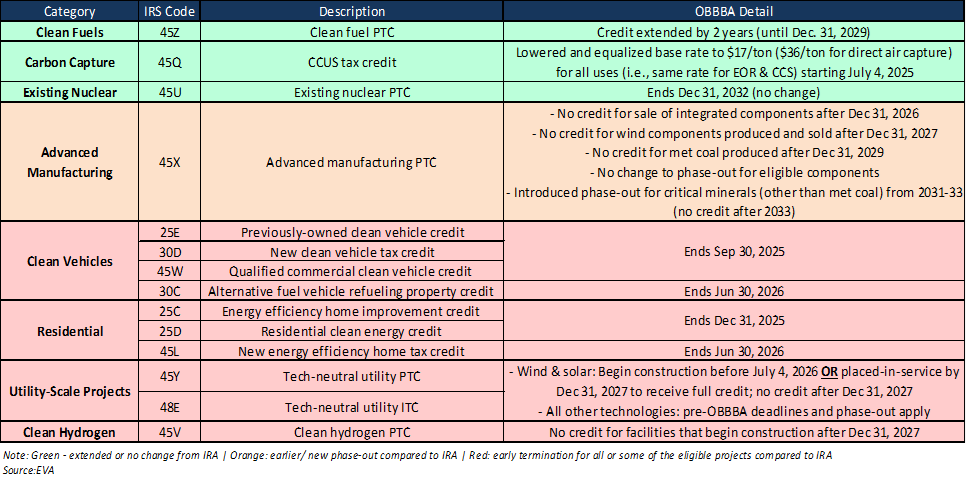

On July 4, 2025, President Trump signed the Senate-amended One Big Beautiful Bill Act (OBBBA). While many of the cuts from the House version remained, the final version of OBBBA introduces a more relaxed condition of eligibility for projects seeking to claim the new tech-neutral clean electricity tax credits (45Y and 48E) with a 12-month “begin construction” provision for wind and solar projects. Solar and wind projects are among the most affected by the credit rollbacks, despite the added flexibility. The summary table below outlines the credits that remain intact with IRA, will be phased out earlier, or undergo early termination.

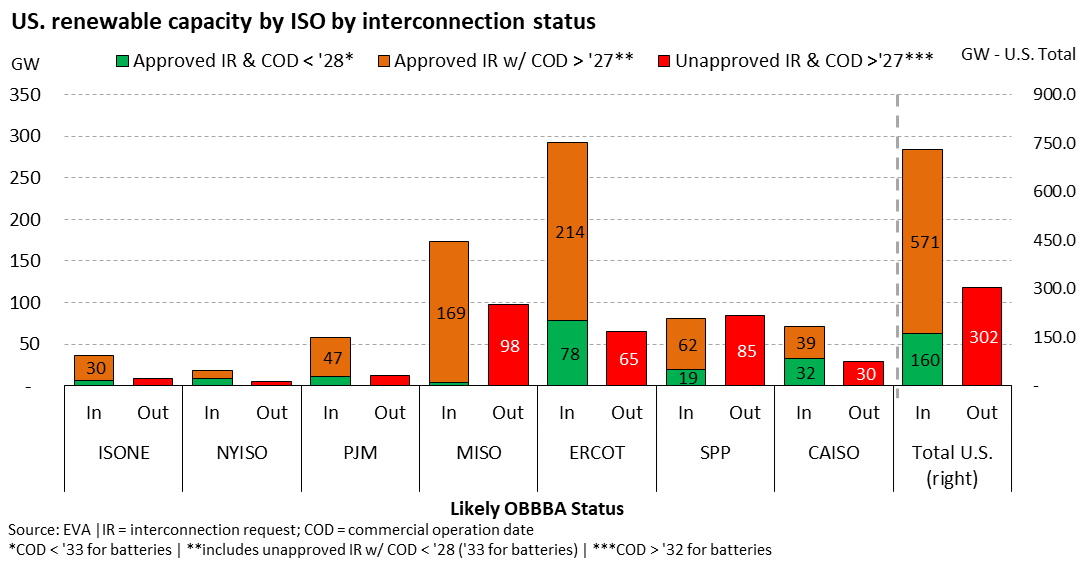

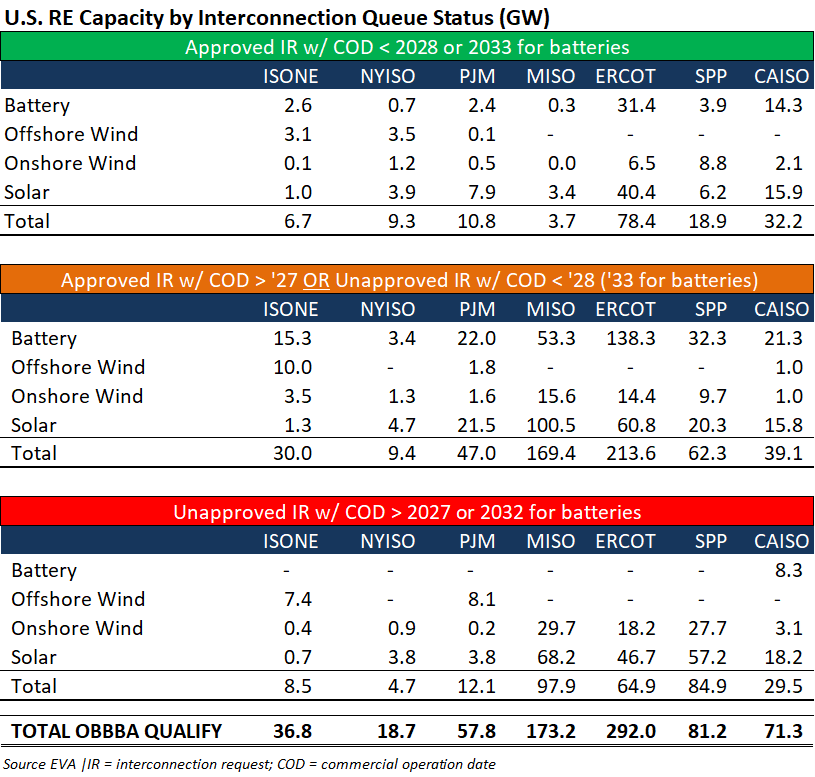

This provision reduces the total GW at risk in the interconnection queue by more than 50%. However, EVA’s analysis, included in the chart below, estimates that about 300 GW across all seven major ISOs will likely be disqualified. Among the disqualifying technologies are nearly 200 GW of solar and nearly 100 GW of wind (both onshore and offshore). The most impacted regions by volume are expected to be MISO, SPP, and ERCOT, followed by CAISO and PJM.

Moreover, the final bill accelerates Foreign Entity of Concern (FEOC) restrictions, immediately disqualifying entities under FEOC control or influence from receiving key clean energy tax credits (45Y, 48E, 45U, 45X, 45Z, 45Q). It also broadens disqualification to include “material assistance” from FEOCs, such as components, IP, or design services. These restrictions apply to credit buyers, though transferability remains until the credits phase out. Elective payment (direct pay) is still available, but tax-exempt entities may be affected similarly to taxable ones.

_____________________________________________________________________________________

Signed Into Law: The One Big Beautiful Bill Act Explained

President Trump inked the Senate version of the One Big Beautiful Bill Act (OBBBA) into law on July 4, 2025. The bill was delivered to the President on July 3, 2025, by Congress after the House accepted the Senate’s amendments and changes. The Senate version of the OBBBA passed the Senate on July 1, 2025, after five weeks of revisions, when Vice President JD Vance cast the tiebreaking vote. The OBBBA is a budget reconciliation bill that, among many other things, scales back the Inflation Reduction Act’s clean energy provisions by introducing a narrower eligibility framework, time-bound credit availability, and technology-specific adjustments to federal support.

Final Eligibility Requirements under OBBBA

The 12-Month Rule

The final version of OBBBA introduces a more relaxed condition of eligibility for projects seeking to claim the new tech-neutral clean electricity tax credits (45Y and 48E), compared to the House version of the bill, which imposed a 60-day construction timeline. A project must meet either of the following:

- Begin construction within 12 months of the bill’s enactment, OR

- Be placed in service by December 31, 2027.

Definition of “Begin Construction”

Failure to meet at least one of the conditions results in complete disqualification from the credits, regardless of prior plans or compliance with IRA-era guidelines. Moreover, the definition of “In-service date” or “begin construction” remains aligned with IRS precedent. A project must either:

- Start physical work of a significant nature (on-site or off-site), or

- Incur at least 5% of total project costs (non-refundable) and maintain continuous progress thereafter.

Final Clean Energy Credit Structure under OBBBA

The OBBBA delivers a sweeping contraction of the Inflation Reduction Act’s clean energy tax platform. In addition to imposing a 12-month construction start deadline or a December 31, 2027, in-service requirement, OBBBA accelerates the phase-out or eliminates nearly all major clean energy credits, with only a few strategic exceptions.

Credits Phased Out or Eliminated

- 45Y/48E (Tech-neutral clean electricity credits): Wind and solar facilities must begin construction within 12 months of the enactment of OBBBA or be operational by the end of 2027 to qualify for tax credits. Wind and solar projects that miss either of these deadlines will no longer be eligible for the clean electricity PTC or ITC. No transitional glide path or partial credit is provided. 45Y and 48E will phase out after 2032 for technologies other than wind and solar.

- 25D[1] / 25C / 45L (Residential Incentives): Residential and consumer energy incentives, including the rooftop solar and battery credit (§25D) and the home energy efficiency credit (§25C), will expire after 2025, removing federal support for the adoption of distributed energy. The new home construction credit (§45L) will expire after June 2026.

- 30D (Clean Vehicle Credit): This credit, along with related credits for used EVs (25E) and commercial EVs (45W), will expire on September 30, 2025.

- 45X (Advanced Manufacturing Credit): Integrated components sold after 2026 will not be eligible for the credit. Wind components produced and sold after 2027 will not be eligible for the credit. Metallurgical coal produced after 2029 will not be eligible for the credit. A phase-down for eligible components begins in 2030 and ends by 2033. A phase-down for critical minerals (excluding metallurgical coal) begins in 2031 and ends by 2034.

- 45V (Clean Hydrogen Credit): Eligibility was extended from earlier versions, so projects that begin construction before January 1, 2028, will be eligible for the credit.

[1] OBBBA disqualifies wind and solar projects from receiving federal tax credits if deployed through residential leasing arrangements or third-party ownership models. Effective for tax years beginning after enactment (i.e., beginning with tax year 2026), this change eliminates eligibility under Section 25D for systems where the lessee, rather than the owner, would otherwise be eligible to claim the credit, impacting common rooftop solar leasing and PPA structures.

Credits That Remain Intact (No Phase-Out)

Only three major IRA-era incentives remain broadly unaffected:

- 45Q (Carbon Capture Credit): Amended to establish cost parity for all uses and utilization, like enhanced oil recovery, and retains full eligibility through 2032.

- 45Z (Clean Fuels Credit): Extended through 2029 but limited to U.S.-Mexico-Canada feedstocks and restricted by foreign entity bans effective immediately.

- 45U (Zero-Emission Nuclear Power Production Credit): OBBBA preserves 45U in full throughout 2032 but adds restrictions relating to prohibited foreign entities. Notably, this credit applies only to existing nuclear power plants that qualify as “eligible advanced nuclear facilities” under Section 45U, defined as zero-emission facilities placed in service before the enactment of the OBBBA.

Taxing Renewable Energy on Federal Land

Solar and wind projects that began construction on Federal land after June 15, 2025, are subject to an acreage rent for rights-of-way until electricity production begins, at which point the project will be required to pay an annual capacity fee equal to the greater of the acreage rent or 3.9% of gross proceeds from the sale of electricity produced by the project. However, these fees are only expected to impact a small portion of solar and wind projects, as the vast majority of projects are not built on federal lands. Nevertheless, the implementation of these fees is contrasted by the relaxation of royalty rates for fossil resources extracted from Federal lands with the goal of promoting U.S. energy self-reliance.

Expansion of Foreign Entity of Concern (FEOC) Restrictions

The OBBBA prohibits any entity deemed to be controlled or influenced by a “Foreign Entity of Concern” (FEOC) from claiming energy tax credits (45Y, 48E, 45U, 45X, 45Z, and 45Q) effective immediately. This reflects an accelerated timeline from earlier drafts. Critically, projects may also be disqualified if they receive “material assistance” from an FEOC, such as components, intellectual property, or design support. For example, by 2030, 75% of the components for energy storage must be sourced from domestic sources to be eligible for credits. Similar limits have been established for solar and wind energy. Given the extensive role of Chinese firms in the global supply chain for renewable energy materials and technologies, complying with these restrictions could pose significant challenges for many clean energy developers.

Disqualification Risks for the Broader Interconnection Queue

The final version of the OBBBA has drastically relaxed the disqualification risk for solar and wind projects. The 12-month “begin construction” trigger reduced the total GW at risk by more than 50% which is primarily driven by projects in the ERCOT and MISO regions. Shovel-ready projects may continue through study and permitting to support grid reliability objectives.

EVA’s analysis of the interconnection queues of the seven major U.S. ISOs (CAISO, ERCOT, ISONE, MISO, NYISO, PJM, and SPP) indicates that approximately 160 GW of clean energy capacity (solar, wind, and battery) with approved interconnection agreements could feasibly meet OBBBA’s eligibility threshold, which is nearly four times the capacity estimated under the House version. Half of this capacity is being developed in the ERCOT region. An additional 571 GW, with interconnection approval and commercial operation dates (CODs) after 2027 or COD before 2028, has a possible path to qualification under the enacted deadlines. Most of this capacity is being developed in the ERCOT and MISO regions. These estimates are still subject to potential reductions in build-out driven by tariff risks or supply chain exposure to foreign entities of concern. ERCOT, CAISO, and SPP stand out with the highest volume of approved projects, signaling faster interconnection processing. In contrast, MISO and PJM face slower approval rates relative to the scale of their queues, limiting the number of projects that can reach construction readiness in a timely manner.

In contrast to the subset of qualifying projects, approximately 30% of the interconnection queue – roughly 302 GW across all seven major ISOs – will likely be disqualified from claiming federal tax credits with the enactment of OBBBA. This includes nearly 200 GW of solar and nearly 100 GW of wind (both onshore and offshore). The most impacted regions by volume are expected to be MISO, SPP, and ERCOT, followed by CAISO and PJM. These losses underscore the potential for widespread disruption to project financing and long-term planning across the U.S. renewables market.

Sector Implications

The combined provisions of OBBBA deliver a decisive policy shift across the clean energy ecosystem. The modification to the 45Y and 48E phase-out provision allows any wind or solar facility to be eligible for the credit if construction begins within 12 months of the Bill and commercial operation begins by the end of 2030. Utilities and merchant developers will likely load up on projects that “begin” construction in the next 12 months. EVA expects a surge of new projects to come in under this provision in the near term. However, the current administration is working to adjust the “begin construction” provision to limit the number of eligible projects, as evidenced by the recent executive order signed on July 7, 2025. More details about the approach to preventing artificial acceleration or manipulation of eligibility will be revealed in the coming weeks.

Even given this updated provision, project cancellations are likely as developers will be forced to reassess timelines and reconfigure supply chains under tight deadlines. At the same time, the elimination of distributed generation (DG) tax credits, such as for residential solar, could increase grid electricity demand as forecasted DG demand shifts back to utility-provided power. The increase in potentially feasible projects, combined with an anticipated slowdown in electric vehicle sales without the federal tax credit, provides some relief from a near-term capacity gap in the face of gas turbine manufacturer backlogs and a massive rise in demand fueled by new data centers.

For a deeper understanding of how these developments impact the renewable energy landscape in various regions, explore EVA’s Monthly Renewable Energy Outlook, our comprehensive report on the U.S. renewable energy space. The marquee report provides unparalleled insights into policy, regulatory, and technological trends, enabling stakeholders to navigate the complexities of clean energy expansion.

To subscribe, request a sample, or for more information, please email us at [email protected]