In early November, Singapore-based Pacific Oil & Gas authorized financing for its 2.1 MMTPA (280 MMCFD) Woodfibre LNG project in Squamish, British Columbia.

The announcement appeared to stop short of a full Final Investment Decision (FID), as it remains contingent on receipt of a few local and provincial approvals. While not guaranteed, those approvals are scheduled for the next few months. Construction is planned to begin in early 2017, with completion set for 2020.

Woodfibre LNG would be the first LNG export proposal to move forward in Canada, an unexpected outcome for a project that has largely flown under the radar. It is one of 22 projects proposed in British Columbia and much of the industry focus has been on the large-scale projects proposed by experienced and well-financed LNG operators—especially Shell’s LNG Canada and PETRONAS’ Pacific Northwest LNG. In contrast, Woodfibre’s developer, Pacific Oil & Gas, is a subsidiary of RGE, a Singapore-based conglomerate with no previous LNG experience. Notably, the company intends to remain the sole owner of the project, whereas other advanced projects brought together partnership structures featuring multiple creditworthy LNG buyers.

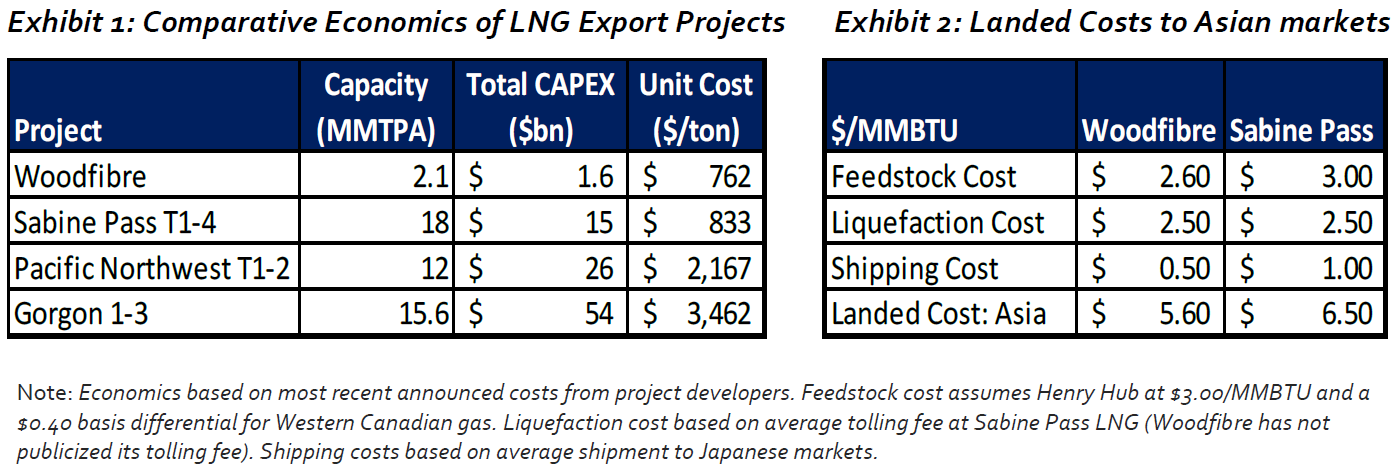

While Woodfibre’s (apparent) success is somewhat unexpected, the project does possess several key advantages. Like all projects on the West Coast of North America, it offers short shipping distances to Asia, equating to half the cost of shipping LNG from the U.S. Gulf Coast. Further, at 2.1 MMTPA, it is a fraction of the size of competing LNG proposals in BC (which generally range from 10-15 MMTPA) and is thus a fraction of the cost. It is also located on an existing industrial site, which reduces cost and complexity. Pacific Oil & Gas estimates full project costs to reach $1.6 billion, far below the $30+ billion estimates for many of the larger competing projects.

Crucially, Woodfibre LNG requires very limited pipeline investment, as the site is already connected to the gas pipeline network feeding the Vancouver area. This allows the project to source low-cost Montney feedstock at a considerable ($0.40) discount to Henry Hub while eliminating the need for newbuild long-haul pipelines stretching across the Canadian Rockies to the BC coast. For other projects, such pipeline proposals suffered from considerable environmental opposition, serious complexity, long development timelines and very high costs. Those pipelines have been, and will remain, enormous obstacles to the development of LNG projects in Western Canada.

Woodfibre LNG’s modest size also simplifies LNG marketing. Larger projects require multiple LNG buyers willing to commit to considerable volumes on a 20-year basis. Thus far, Woodfibre has only announced one offtake contract—a 1 MMTPA Heads of Agreement (HOA) with Guangzhou Gas Group, a Chinese gas distributor.

That being said, the offtake agreement is a core source of uncertainty for Woodfibre LNG, as it appears to be non-binding and accounts for less than half of total project capacity. Most LNG export projects are not sanctioned until at least 70% of capacity has been contracted under binding agreements, but Pacific Oil & Gas appears willing to accept the risk of moving forward without a guaranteed (and thus bankable) source of long-term revenue.

The prudence of such a strategy is questionable, but is reflective of the dire straits facing LNG project developers in the current LNG market. With multiple large export projects coming online in Australia and the United States, the industry is preparing for a considerable supply glut over the next several years. Many major buyers are already over-contracted; those who are not have little interest in signing long-term contracts underpinning new projects. Given the paucity of buyers, many developers have cancelled or delayed projects until the market tightens post-2020.

Woodfibre appears content running against this trend, believing there is still room for a small-scale project that, with access to low-cost feedstock and close proximity to Asian markets, can reliably undercut U.S. LNG on price. There remains a risk that environmental opposition emerges, especially given the project’s location near Vancouver. The status of the sole HOA is uncertain, as well, and will likely need to be finalized.

Yet, if Pacific Oil & Gas can check those boxes, Woodfibre LNG is well positioned to finally add Canada to the list of LNG exporters.

If successful, Woodfibre LNG could also instill confidence in many of the other low-profile proposals in Western Canada. Several projects in Canada, including Malahat LNG and Sarita Bay LNG, offer advantages similar to Woodfibre. None, however, are nearly as advanced as Woodfibre. Most have not even begun the lengthy environmental approval process and contracting has been non-existent.

Thus, while Woodfibre demonstrates the advantages of small-scale LNG, broader market trends will make it a difficult model for other Canadian projects to replicate in the near-term. The trend will be more apparent elsewhere, as small projects like Elba Island (which recently began construction in Georgia) and Coral FLNG (offshore Mozambique, moving toward FID) appear heavily advantaged compared to massive large-scale projects.