EVA’s Energy Trader Dashboard (ETD): Term Power Outlook is a one-stop shop for Power Marketers and Traders, providing daily market insights of the futures market using a fundamentals-based analysis. The report provides a comprehensive view of the factors driving changes in power prices across major U.S. markets including NYISO, ISO-NE, PJM, MISO, ERCOT, SPP, and CAISO.

The Term Power Outlook compares two viewpoints: 1) Market 2) Fundamentals. While the market view on power and gas comes from the Intercontinental Exchange (ICE) futures, the Fundamental view is derived from EVA’s proprietary modeling of U.S. power markets.

EVA uses the daily settled futures prices from ICE for all major power hubs to provide a market view. For fundamentals, EVA uses the AURORA power dispatch model to forecast power prices by hubs and zones for all major power markets across the U.S. EVA’s well-calibrated power dispatch model simulates the operations each power plant in the country on an hourly basis. For this analysis, EVA uses the market gas prices and EVA’s proprietary coal and oil price forecasts. EVA also uses its own forecast for electricity demand which is derived using various econometric parameters including weather.

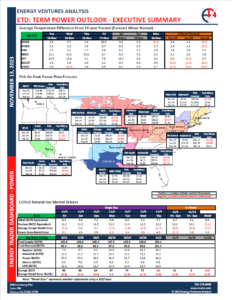

The report starts with a snapshot of the market over the past seven days and expectations for the next three months. This summary includes day-ahead power prices, gas prices, spark spreads, break-even heat rates, basis spreads, weather, and demand.

Additionally, a sensitivity analysis provides a three-month power price outlook for low, base and high electricity demand cases based on EVA’s modeling. On the supply side, the generation and capacity outlook by fuel type provides a glimpse of the competition between the fuels at various electricity demand levels. The full-load supply stack helps visualize the position of each fuel type based on their relative production costs.

By comparing the market and fundamental views, the Term Power Outlook identifies instances in which the market is bullish or bearish and provides an opportunity to the traders for course correction on their market positions on a daily basis.

To subscribe, request a sample, or for more information, please email us at [email protected].